Introduction

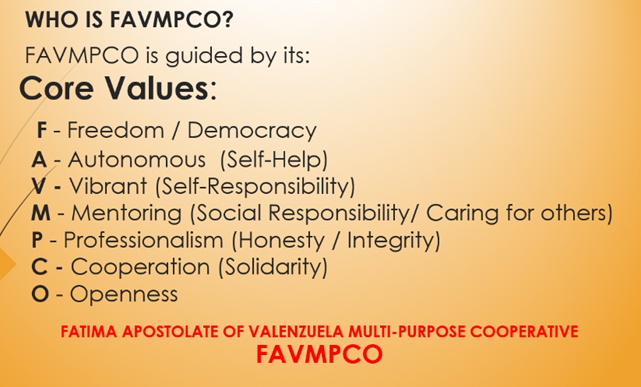

Coop Overview

Year in Service

Total Member

Total Project

Website Visitor

About Us

History

FAVMPCO History

May 24 -27, 2001

WAF National Convention

June 09, 2001

First orientation by Mr. Epifanio Galinato

August 30, 2001

CDA approved registration

September 09, 2001

General Concept of a Cooperative:

A cooperative is an autonomous and duly registered association of persons

With common bond of interest (nagkakaisang layunin).

Voluntarily (kusang-loob) joined together to achieve social, economic, and cultural needs and aspirations by making equitable contributions to the capital required.

Patronizing products and services.

Accepting a fair share of the risks and benefits of the undertaking in accordance with universally accepted cooperative principles.

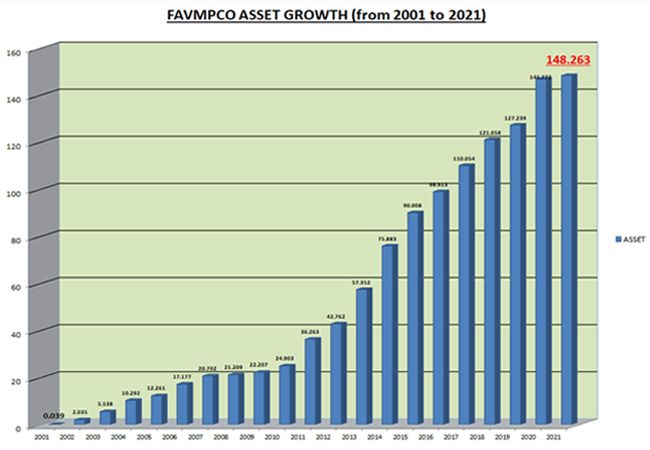

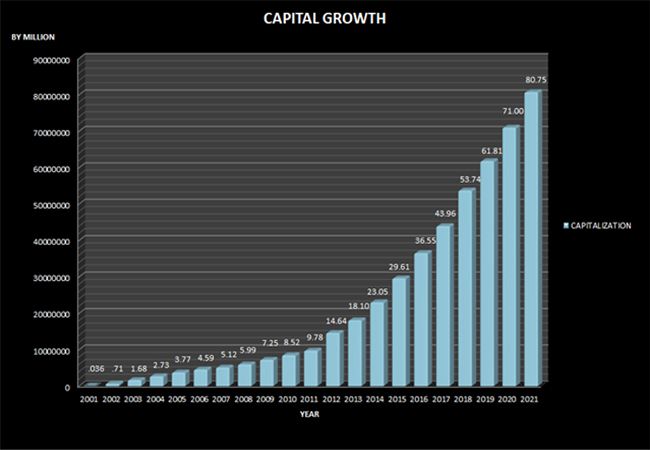

ASSET GROWTH:

| 2001 | 2022 | |

| Total Asset: | Php 39k | Php 148M |

| Share Capital: | Php 36.8k | Php 80.75M |

| Net Profit: | Php 2,598 | Php 3.49M |

| Membership: | 39 members | 1407 members |

PRODUCE OFFERED:

2001 – 2005

2006 – 2010

2011 – 2015

2015 – PRESENT

About Us

FAVMPCO Officers and Staff

| BOARD OF DIRECTORS |

| ELECTION COMMITTEE |

| AUDIT COMMITTEE |

| BOARD SECRETARY |

| BOARD TREASURER |

| CREDIT COMMITTEE |

| ETHICS COMMITTEE |

| EDUCATION & TRAINING COMMITTEE |

| MEDIATION & CONCILIATION COMMITTEE |

| GENDER & DEVELOPMENT COMMITTEE |

| COLLECTION & STEWARDSHIP COMMITTEE |

| YOUTH COMMITTEE |

| MANAGEMENT STAFF |

About Us

Our Linkages & Communities

Our Linkages

Services

Loan Portfolio

REGULAR LOAN

| Interest Rate: | 1% per month(12% pa) deducted in advance | ||||||||||

| Service Charge: | 2.5% | ||||||||||

| Filling Fee: | .1% | ||||||||||

| CBU: | 3% retention | ||||||||||

| Term of Payment: | maximum of 12 mos. | ||||||||||

| Deposit Requirement: | Based of member's classification | ||||||||||

| Security/Collateral: | Share Capital/Savings or Time Deposit | ||||||||||

| Maximum Loan Amount: | Php 60,000.00 | ||||||||||

| Mode of Payment: | Equal installment (monthly/weekly) | ||||||||||

|

Characteristics:

1. There are two (2) type of Regular Loan

|

|||||||||||

EMERGENCY LOAN

| Interest Rate: | 4% |

| Service Charge: | 2.5% |

| Filling Fee: | .1% |

| Term of Payment: | 2 mos. |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | Deposits |

| Maximum Loan Amount: |

Php 2,000.00 with existing loan Php 3,000.00 without existing loan |

| Mode of Payment: | Equal monthly installment |

|

Characteristics:

1. Emergency Loan is a lending facility for members for the purpose of paying miscellaneous expenses like tuition fess, electric and water bills, hospitalization and medical bills.

2. Member can avail this loan on top of another loan, provided, that 50% of his/her existing loan have already been paid. 3. He/she is not in arrears in his/her existing loan (Class A). 4. No co-maker is required. |

|

CHECK REDISCOUNTING

| Interest Rate: | 4% |

| Term of Payment: |

1 month renewable for another month Maximum of two (2) months |

| CBU: | 3% retention |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | Deposits/PDCs/REM |

| Maximum Loan Amount: | Php 50,000.00 |

|

Characteristics:

1. Check Rediscounting is a privilege for Class A members only.

2. With existing business profitable business (one year). 3. Must have an existing current deposit account for at least three (3) months without any record of bouncing check. 4. Personal Check only. 5. General Manager's approval only but should be reported monthly during BOD meeting. 6. Payable and demandable on due date. 7. The loan can be paid in cash on due date, otherwise the check should be automatically deposited on due date. 8. Penalty for unpaid Check Rediscounting shall be 4% of the amount of loan. |

|

LOAN AGAINST SHARE DEPOSIT (LASD)

| Interest Rate: | 1% per month (12% pa) deducted in advance |

| Service Charge: | 2.5% |

| Filling Fee: | .1% |

| CBU: | 3% retention |

| Term of Payment: | 3 months to 12 mos. |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | Share Deposits |

| Maximum Loan Amount: | amount of share deposit |

| Mode of Payment: | Equal installment (monthly/weekly) |

|

Characteristics:

1. Upon Manager's approval only subject to post audit.

2. No outstanding unsecured loan or First Time Borrower. 3. Can avail a loan equivalent to 100% share capital. 4. Co-maker not required. 5. Loan can be release within the day. |

|

LOAN AGAINST TIME DEPOSIT (LATD)

| Interest Rate: | 1% per month (12% pa) deducted in advance |

| Service Charge: | 2.5% |

| Filling Fee: | .1% |

| CBU: | 3% retention |

| Term of Payment: |

3% months to 12 mos. Maturity is 5 days before time deposit matured |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | Time Deposits (cannot be withdrawn unless LATD is fully paid and no partial withdrawl) |

| Maximum Loan Amount: | amount on Time Deposit |

| Mode of Payment: | Equal installment (monthly/weekly) |

| Documentation: | Assignment of Certificate of Time Deposit |

|

Characteristics:

1. Upon Manager's approval only subject to post audit.

2. No outstanding unsecured loan or First Time Borrower. 3. Can avail a loan equivalent to 100% time deposit. 4. Co-maker not required. 5. Loan can be release within the day. |

|

|

Documentation:

1. Original Transfer Certificate of Title (TCT), applicant must be the sole owner of the land or improvement.

2. Tax Declaration for land, improvement or both - original & issued within 5 years. 3. Tax Clearance. 4. Tax Receipt for the year 5. Certificate as to the genuineeness to the Title (Register of Deeds) 6. Vicinity Map 7. Special Power of Attorney (in case the borrower is not the owner of the said collateral) 8. TIN of Borrower 9. Picture of the Property Location 10. CTC - Original/Current 11. REM |

|

|

Requirements:

1. Only lot is acceptable collateral, improvements is secondary.

2. Title should be within Valenzuela only. 3. No co-maker is necessary. 4. Loans for spouses should be treated as one. 5. There should be an appraisal report by duly authorized person of the BOD. 6. Share capital should be 20% of the loan being applied. 7. Encumbrance os to be annotate on the mortgage paper before the loan is released. |

|

SSS/GSIS PENSIONER LOAN

| Interest Rate: | 16% per pa |

| Service Charge: | 2.5% |

| Filling Fee: | .1% |

| Insurance: | 2% insurance of loan |

| Term of Payment: |

75 years old and below - maximum of 12 months 75 years old and below - maximum of 6 months |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | SSS/GSIS Bank Savings Passbook or ATM Card |

| Maximum Loan Amount: | Loanable amount is 90% of monthly pension, maximum of Php 60,000.00. The remaining 10% will be deposited to pensioner savings account. |

| Mode of Payment: | Equal monthly installment. To be withdrawn by FAVMPCO authorized representative from the Bank account or ATM. |

| Documentation: | Assignment/Turn-over of passbook/ATM Card |

|

Characteristics:

1. Pensioner Loan is granted to ALL FAVMPCO members with SSS and GSIS Pension.

2. Should secure authorization document from the pensioner. (i.e authorization letter with copy of SSS ID) 3. Should submit the following: 5. Interest and all charges are deductible from the loan proceed. 6. Loan approval up to Manager's level only. Board approval is needed in excess of maximum limit. 7. In case of default, a two per cent(2%) penalty per month will be imposed to the loan balance.

Note: Other existing loans should also be consided because capacity to pay will be a problem.

|

|

MEMORIAL SERVICE LOAN

| Interest Rate: | 12% per pa deducted in advance |

| Service Charge: | 2.5% |

| Filling Fee: | .1% |

| CBU: | 3% retention |

| Term of Payment: | minimum - 1 year maximum - 3 years |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | Share Capital/Deposits and Plan Certificate of Full Payment |

| Maximum Loan Amount: | Php 100,000.00 |

| Mode of Payment: | Equal monthly installment |

| Documentation: | Assignment/Turn-over of passbook/ATM Card |

|

Characteristics:

1. Privilege to Class A members only

2. Co-Maker required 3. Approval of Manager up to Php 60,000.00 principal 4. Approval of Board of excess of Php 60,000.00 principal 5. Memorial Service Company should have approval of SEC (i.e PAZ, etc.) |

|

REAL ESTATE MORTGAGE LOAN (REML)

| Interest Rate: | 1st year - 1% per month (12% pa) deducted in advance 12% p.a. succeding year - add on interest - straight line method |

| Service Charge: | 2.5% |

| Filling Fee: | .1% |

| CBU: | 1% retention |

| Inspection Fee: | 1% |

| Appraisal Fee: | 1% |

| Insurance: | Php 8.50 per thousand per annum |

| Term of Payment: |

Maximum term of one (1) year Maximum term of three (3) years |

| Deposit Requirement: | Based of member's classification |

| Security/Collateral: | Real Estate Property (residential or commercial) within Valenzuela only |

| Maximum Loan Amount: | Php 300,000.00 (50%+70% zonal or appraised value whichever is lower, other requirements for considerations) |

|

Payments:

1. Equal monthly installments.

2. A grace period of five(5) calendar days is in order. 3. Any delayed payment is subject to 2% penalty per month of monthly amortization. 4. Non-payment of loans for six(6) months is considered in default, thus making the whole amount due and demandable at once including the interest, penalties and other surcharges so computed. |

|

Services

Type of Member & Termination

Regular Member:

Associate Member:

Type of Share Capital

PAID-UP SHARE CAPITAL (COMMON):

PAID-UP SHARE CAPITAL (PREFERRED):

Initial Investment

a. Regular Member:

| Php 5,500.00 | - (minimum) |

| Php 4,000.00 | - Share Capital (Common) |

| Php 1,000.00 | - Savings Deposit |

| Php 300.00 | - Insurance |

| Php 200.00 | - Membership |

b. Associate Member:

| Php 3,500.00 | - (minimum) |

| Php 2,000.00 | - Share Capital (Preferred) |

| Php 1,000.00 | - Savings Deposit |

| Php 300.00 | - Insurance |

| Php 200.00 | - Membership |

Termination of Membership

1. Voluntary withdrawal:

A member may withdraw his/her membership from cooperative by giving sixty (60) days notice to the BOD. The withdrawing member shall be entitled to a refund of his/her share capital contribution and all other interests.

2. Death of a member:

FAVMPCO will refund to the beneficiary/ies the share capital contribution and interests provided the member has no outstanding obligation. Otherwise, loan amount will be deducted from the share capital and/or interests.

3. Insanity of a member:

FAVMPCO will refund to the beneficiary/ies the share capital contribution and interests provided the member has no outstanding obligation). Otherwise, loan amount will be deducted from the share capital and/or interests.

4. Vote of majority of BOD for any of the ff causes:

a. Member has not patronized any of the services or products for a reasonable period of time.

b. Member has continuously failed to comply with his/her obligation

c. Member has acted in violation of the by-laws and rules of FAVMPCO.

d. Any act of omission injurious or prejudicial to the interest or welfare of FAVMPCO.

Services

Member Benefits & Insurances

Members availing loan are entitled to Patronage Refund

Members increasing share capital receive BIGGER dividend

Members patronizing FAVMPCO products can save due to discounted price (CDO, Rice, etc)

Members are entitle to discount in the use of PATIO DEL FAVMPCO

Members in good standing (MIGS) can easily avail of loans

Members are insured upon approval of his/her membership

Qualification for MIGS:

Insurances:

News

News

*** No Records ***

Gallery

Gallery

Contact Us

Contact Info

Our Address

KofC Corner St, 2nd Floor FAVMPCO Building Fatima Avenue, Marulas Valenzuela City

Email Us

favmpco2001@gmail.com

Call Us

Landline#: 8292-5067

Mobile#: 0917-5696497

Contact Us

Map Location